Fintech Affiliate Marketing

What It Is, Why It Works, and How to Get in the Game

It’s no secret that consumers have been losing trust in banks and large financial service firms in recent years. The Great Recession of 2007-2009 and the 2023 failure of Silicon Valley Bank and other institutions have had a sobering impact.

TLDR Summary

Fintech is growing amid consumer distrust in banks. Fintech affiliate marketing relies upon influencers, bloggers, and affiliate sites to promote their financial technology products and services. Affiliate marketing is becoming the preferred approach by fintech companies for its efficacy and high ROI. Fintech companies can implement affiliate marketing programs in-house or work with specialized agencies.

The Remedy for Overlooked Consumers

This dwindling confidence in banking runs in stark contrast to the rapid advances in AI and digital technology that have punctuated recent decades.

As consumer trust in the traditional finance sector has shrunk, new, more trusted fintech (financial technology) products have emerged. Popular, recent-year examples include cryptocurrency, non-banking financial institutions, alternative loans like peer-to-peer lending, micro-investment apps, and an arsenal of products for the traditionally unbanked consumer like peer-to-peer payment systems, reloadable Visa cards, and payroll debit cards.

Leveraging Human Connections

Influencers, bloggers, and affiliate marketers have been at the forefront of this fintech rise, heralding these advances. Consumers are looking to these trusted individuals as a primary source of financial advice.

Smart financial brands, including established institutions and savvy up-and-comers, are leveraging the power of human connection to see explosive growth in revenue and new users.

Fintech companies of all sizes can accelerate growth through affiliate marketing. For unknown brands, influencer or affiliate marketing can bring trusted exposure to your brand. And for more established or “stale” brands, influencers can reshape the consumer’s perception.

Better Bang for Your Marketing Buck

According to a Forrester study, over 80% of all brands are setting aside at least 10% of their budget for affiliate partnerships and programs. A majority of brands state that their affiliate program accounts for over 20% of their annual revenue. And within the finance sector, banks and fintech brands are rapidly increasing their affiliate program spend.

As a top executive at Our.com told Forrester, “We’ve seen that affiliate is one of our best ROI channels. It yields more revenue for our [website] than SEM, display, or social.”

Interest, and spending, in affiliate and influencer marketing are at an all-time high.

Here’s what you need to know about pursuing affiliate marketing for your fintech company. We’ll cover what we mean by affiliate marketing and show specific, successful examples of affiliate marketing in finance. We’ll also discuss fintech affiliate marketing agencies (yes, there are many agencies that specialize in this niche!) and cover services that a fintech affiliate marketing agency can provide.

What is Affiliate Marketing?

Affiliate marketing is a form of marketing where businesses pay other people or programs to refer their customers, readers, or followers to the businesses’ products and services.

Businesses can pay these people and programs, affiliate publishers, for just sending traffic (website visitors) or for sending customers that complete a specific action like installing an app, making a purchase, or signing up for a newsletter.

Affiliate publishers can be bloggers, vloggers, social media influencers, or rewards sites like the cash-back shopping program Rakuten. Businesses can work directly with a particular affiliate partner, or they can work with an affiliate network. An affiliate network can connect a business to hundreds or thousands of potential affiliate publishers. This increased audience reach can help you reach your sales and revenue goals more efficiently.

What is Affiliate Marketing in Finance?

In finance, affiliate marketing involves financial services companies using third-party affiliates — bloggers, influencers, and financial services affiliate programs — to promote their services or bloggers.

These affiliates earn a flat rate or commission for sending leads, traffic, or customers. Generally, these affiliates have a human connection with consumers which fosters trust. Also, they do a good job of explaining more complicated products, such as insurance policies or investment apps, to industry outsiders.

Overall, affiliate marketing in finance is a proven method for financial technology companies to reach their customers (existing demographic) and tap into new customer bases.

What Are Some Forms of Affiliate Marketing Fintech?

Affiliate fintech marketing can take on many forms. Here are some of the most common examples:

- Cash back or referral bonuses are offered on rewards sites like Rakuten, Honey, or Kashkick. Here, new customers are motivated to sign up in order to earn a cash reward. The affiliate publisher, like Rakuten, earns a commission and gives a portion of that commission to their customer as an incentive for joining the advertised fintech program.

- Features in articles on news sites. Content affiliates for fintech and other consumer goods and services include Forbes, The Penny Hoarder, New York Magazine, and Los Angeles Times. These may be reviews, listicles, or syndicated content, but they will contain paid links to a fintech or other brand they are featuring.

- Social influencers. Many consumers actively seek financial information on social channels. Life hacks of all kinds are popular, and this includes hacks for making and managing money. Instagram, YouTube, and TikTok are three popular platforms for financial influencers.

- Bloggers. Blogging is a powerful platform to share information and build human connection. Many popular blogs center on ways to make, save, or manage your budget, and they commonly feature fintech companies. Some of these more popular blogs include WalletHub, Nerd Wallet, The Points Guy, The Savvy Couple, and Thrifty Traveler.

What Are Some Popular Fintech Companies Using Affiliate Marketing?

A number of popular fintech companies, banks, and similar industries use affiliate marketing. Here are some examples.

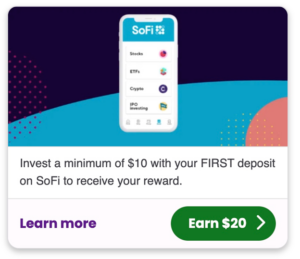

SoFi Bank

One of the nation’s largest financial institutions, SoFi offers traditional banking products and more innovative fintech offerings.

SoFi leverages affiliate and influencer marketing heavily. It works with affiliate partners across social media, blogs, and cashback rewards programs. In this example, SoFi partners with Kashkick to offer Kashkick’s members $20 free for investing a minimum of $10 in their new SoFi Invest account.

Chime

Not a bank, Chime is a financial technology company that provides many of the same services that a bank or credit union does. Chime is known for its no-fee checking accounts that have no overdraft fees, early payday, and generous new customer signup bonuses. A huge player in the fintech space, Chime embraces affiliate marketing heavily across TikTok (working with #finktok influencers), YouTube, bloggers, and personal finance affiliate sites.

Credit Karma

Many consumers are familiar with Credit Karma, the personal finance company founded in 2007. Credit Karma is a free service for consumers to track their scores, improving their financial health and limiting unpleasant surprises. Credit Karma relies heavily on influencer and affiliate marketers in the financial world. It works with a wide range of affiliate publisher partners including financial news sites, loyalty and rewards sites, finfluencers (Fintok influencers), and YouTubers.

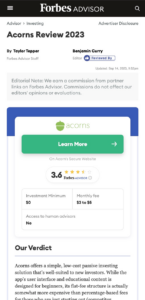

Acorns

Micro-investment app, Acorns, is known for its sleek branding, strong SEO game, and giant presence in the affiliate partnership space. Acorns is featured especially heavily on financial news sites in reviews and listicle-type articles. These write-ups are often syndicated features that contain affiliate (paid) links. In this example, the Forbes article is full of links to Acorns that all contain affiliate tracking. Forbes is paid a commission for sending the fintech app new customers.

Are There Fintech Affiliate Marketing Agencies?

Yes, there are agencies that specialize in marketing fintech products. This includes outfits like Vibrant which specialize in fintech affiliate marketing, or firms that specialize in branding or public relations.

These agencies have the skills, expertise, and industry relationships to navigate a highly regulated industry and deliver the most efficient return on a fintech company’s ad spend.

Most fintech agencies will focus on clients in fintech and similar industries like banking, investment, or insurance.

What Services Does a Fintech Marketing Agency Provide?

Financial services affiliate marketing, like the financial industry itself, is heavily regulated. Beyond regulatory compliance, a fintech marketing agency assists with branding, public relations, crisis management, content marketing, and driving traffic, leads, and conversions.

Here’s an overview of some of the most common services.

- Branding: Agencies can craft or guide the voice and image of your brand so that it’s memorable and meaningful to your audience. They can create the marketing strategies for you, or create and execute the entire campaign from A to Z.

- Social media: Services here can range from offering guidance to creating content for you. Some agencies can even offer full-time social account management.

- App store optimization (ASO): Agencies can optimize and re-optimize your app store listings for optimal performance in Android and Apple stores, using best practices for length, keywords, and other description components.

- Content marketing: Crucial to your brand’s efforts as content marketing will introduce visitors to your brand, highlighting how it works, establishing credibility within a couple of seconds, and providing financial literacy in an easy-to-grasp way. This includes written text, landing pages, images, infographics, FAQs, videos, and reels.

- Influencer marketing: Agencies can help in many ways, from offering guidance to connecting you to the right influencer affiliate partners. Some agencies can manage all of the work for you — finding, hiring, and managing the influencers, overseeing content creation, and remuneration.

- Affiliate marketing: Agencies that specialize in this niche can connect you to the best affiliate partners and publishers, or execute the campaigns for you. They have expertise in selecting the best affiliate networks, managing marketing budgets and overall digital ad spending, negotiating rates, tracking leads, automating reports, and creating dashboards.

- Pay-per-click marketing: Most fintech agencies will offer extensive pay-per-click (PPC) and paid advertising services across paid search, paid social, display, and similar marketing channels. This also includes retargeting, audience segmentation, attribution, and conversion rate optimization (CRO).

Bottom Line

Fintech affiliate marketing is a disruptive and dynamic force in an era of declining consumer trust in traditional banking systems. This approach leverages the authenticity and likability of influencers, bloggers, and affiliate sites, fostering credibility among consumers.

This personalized touch is a must, as fintech relies on digital technology and human connection to drive the adoption of new technologies and significant growth in user base and revenue.

As the fintech industry continues to evolve, the role of specialized financial marketing agencies is becoming increasingly vital. These agencies can provide needed guidance to navigate a highly regulated domain, as well as craft effective campaigns that make your financial brand memorable and endearing.

Many financial companies take a hybrid approach, doing much of their affiliate marketing in-house and also working with outside agencies to scale their outreach with complementary expertise.

Let’s dive deeper into fintech affiliate marketing